US Economy Continued to Grow 4th Quarter 2023

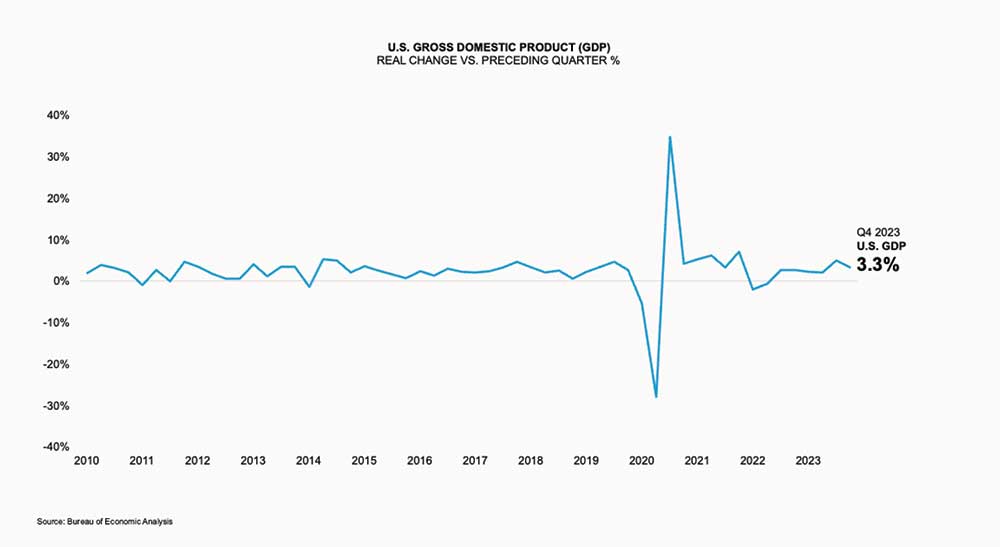

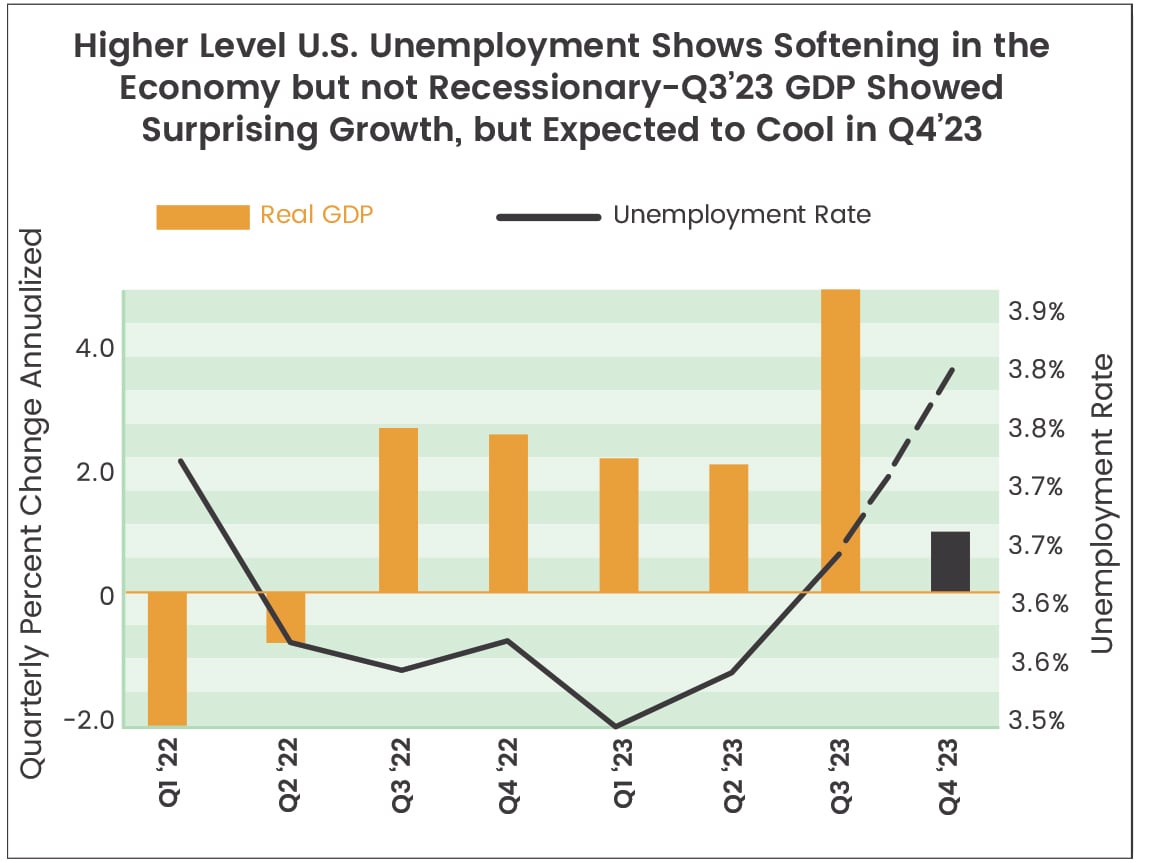

Despite headwinds from elevated inflation and higher interest rates, the U.S. economy in 2023 was much stronger than predicted when the year began. The economy grew 3.1% in the fourth quarter from a year earlier although the results were not without difficulties.

- Early in 2023, a banking crisis was averted.

- Inflation eased but borrowing costs for consumers and business rose as the Federal Reserve lifted its targeted interest rate to a 22-year high.

- Geopolitical turmoil in Europe and the middle east escalated and became a major threat to the global economy.

Following a spectacular 4.9% annual increase in the third quarter 2023, Real Gross Domestic Product (GDP) rose at a 3.3% annual rate in the fourth quarter. This was better than expected with increases in:

- consumer spending,

- nonresidential fixed investment,

- state and local government spending,

- exports, and

- ederal government spending.

These increases were partly offset by decreases in residential fixed investment and inventory investment. Imports also decreased. Throughout 2023, real GDP was 2.5% above its 2022 level, an acceleration in growth from the 1.9% recorded in 2022.

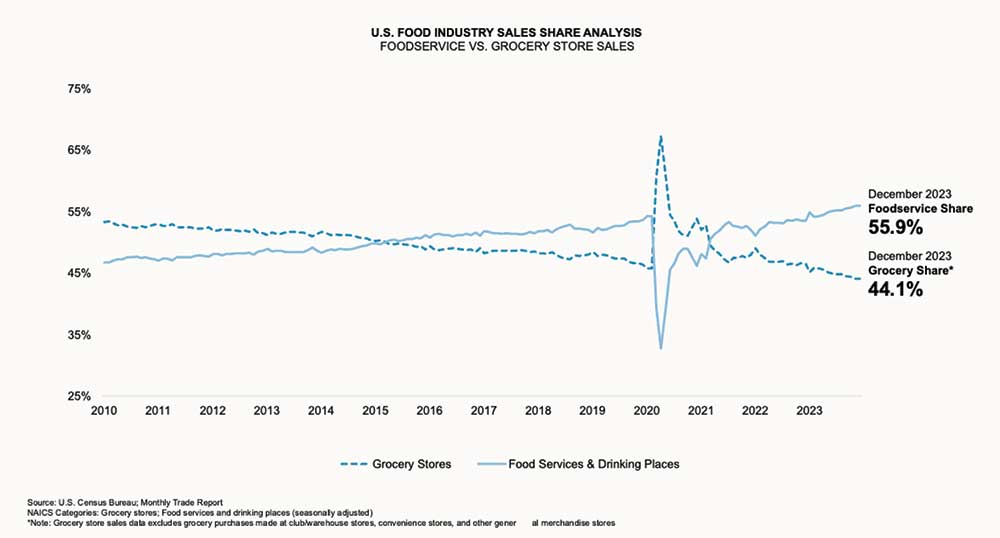

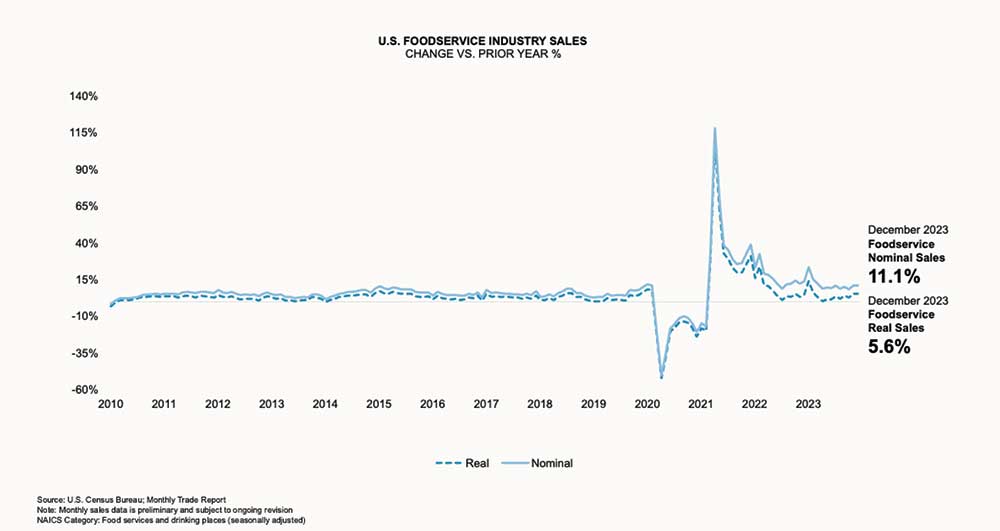

Americans spent at a solid pace in December, with consumers providing resilience to the U.S. economy. Overall, consumer spending rose 5.9% over the course of 2023. Retail spending, a litmus test for households’ budgets rose 5.4% compared to 2022. Sales at food services and drinking places was up 11.1 % on the year rose the most among retail business categories over the last 12 months.

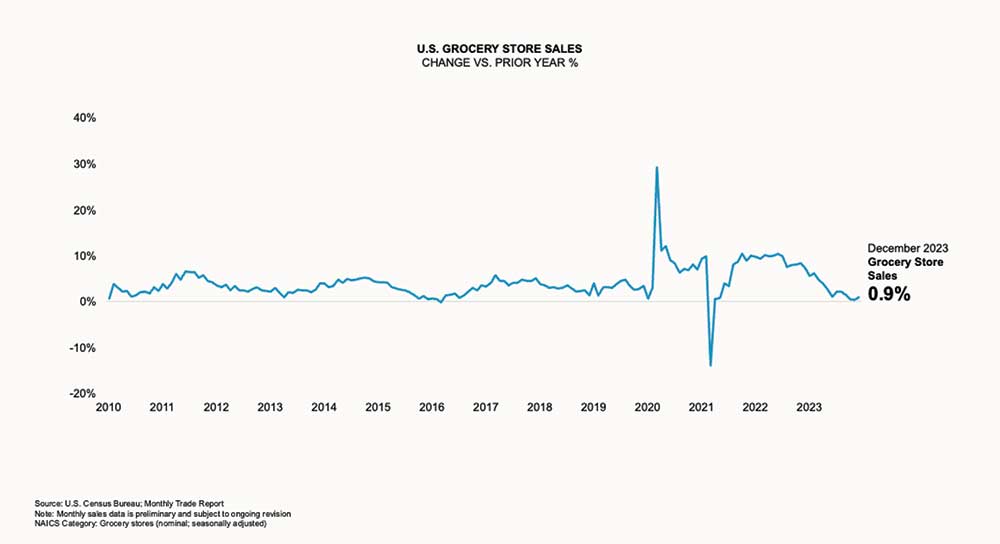

Sales at grocery stores were relatively flat with a 0.9% increase over 2022.

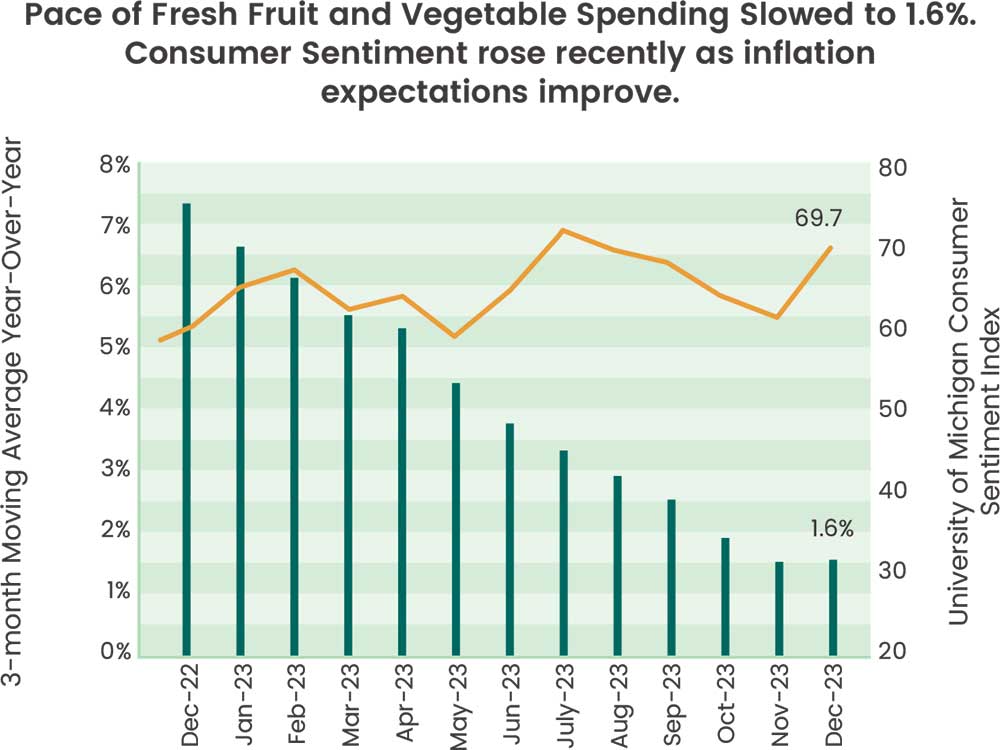

Fresh fruit and vegetable sales grew steadily throughout 2023. Sales averaged $127,294 million for the fourth quarter on an annualized seasonally adjusted basis. Sales for the same quarter for 2023 averaged $125,316. While growing, the pace of growth declined. Compared to the same quarter a year earlier first quarter sales grew 6.1%, 4.5% in the second quarter and 2.9% in the third quarter, and only 1.7% in the fourth.

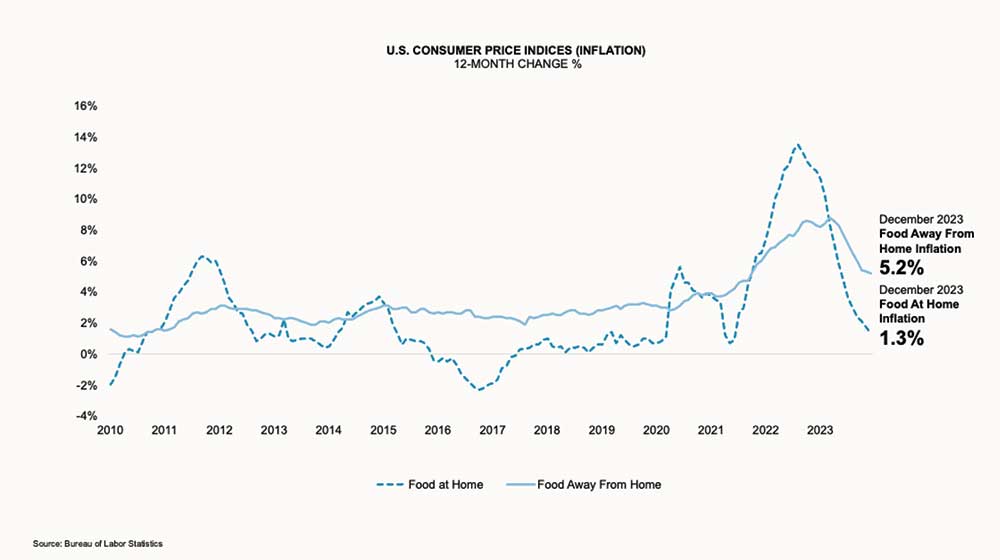

Overall food inflation plummeted the end of 2023 to 2.7%. This was less than the end of year general inflation rate of 3.4%.

Food away from home continues to struggle with much higher inflation than food at home. This is expected to continue into 2024.

Inflation eased as Fed officials and many analysts desired. We are seeing progress on inflation although the pressure of higher prices remains. The personal consumption price index - the Fed’s preferred inflation measure -declined to a 3.4% annual rate in the third quarter, nearly half the 6.6% for the same quarter a year earlier. Combining these indicators, a weaker pace of spending is ahead.

The brisk pace of the third quarter is not expected in the closing months of 2023. The current stance of monetary policy and associated level of interest rates is tight even though the economy sustained itself better than most expected.

Although September’s PCE deflator came in a touch lower than August, it still represents a significant deviation from the Federal Reserve’s ongoing campaign to bring inflation down its 2% target. The BlueChip Economic Indicators panel of forecasters, predict slower growth right now and should continue to do so over the next several quarters as interest rates remain high. Most panelists do not expect a recession over the next 12 months.

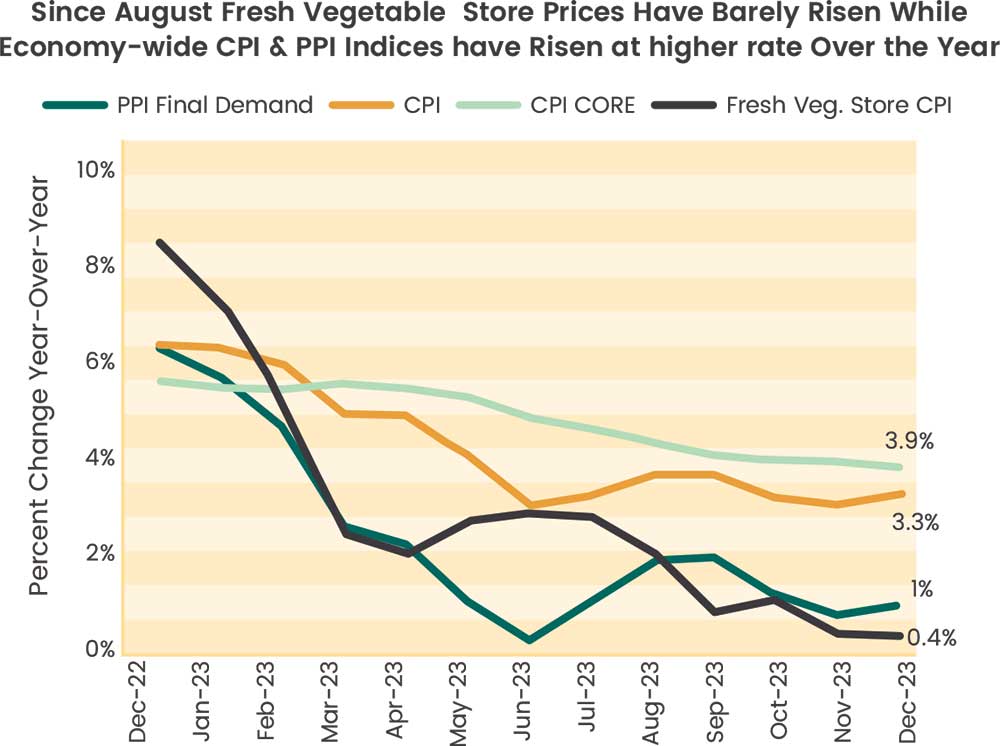

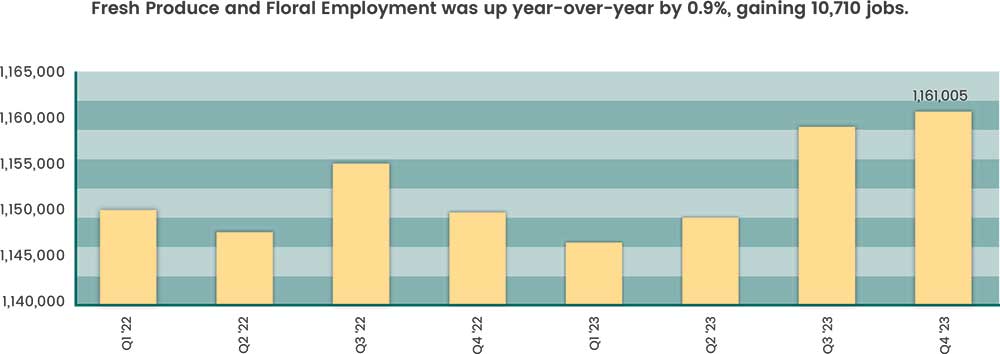

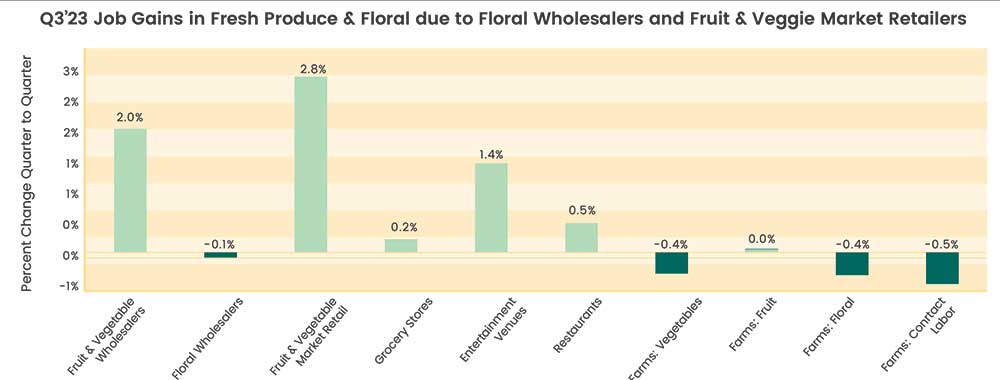

Fruit and vegetable prices at the store may remain elevated but their inflation rates declined from the 6-10% year-over-year rates witnessed in 2022. In December, vegetable prices declined, showing a negative 5 percent inflation rate year over year while fruits had an inflation rate of 3.6%. Both, below the 3.9 core CPI inflation rate. Fresh produce and floral employment increased during the fourth quarter to 1,161,005, 1 percent ahead of employment from this time last year.

In recent months inflation fell meaningfully. Inflation as measured by the personal consumption expenditures price index, the Fed’s preferred inflation measure, eased in December 2023 to 2.6% over the 12-months through December. The core PCE index which excludes volatile food and energy prices rose 2.9% for the same period. Both are the lowest since March 2021 at the very start of the inflation surge.

The Federal Reserve Bank of New York’s December 2023 Survey of Consumer Expectations, shows a marked decline in consumer inflation expectations across time horizons. The current outlook for inflation one year ahead dipped from 3.4% to 3.0%, the lowest in nearly two years. Over three years, this expectation fell from 3.0% to 2.6%, and over five years, it declined from 2.7% to 2.5%. The survey also analyzed Americans’ expectations about households’ financial situations. The expected growth in monthly overall household spending over the next year decreased to 3.0 percent in December, from 3.4 percent in August, its lowest reading since December 2020.

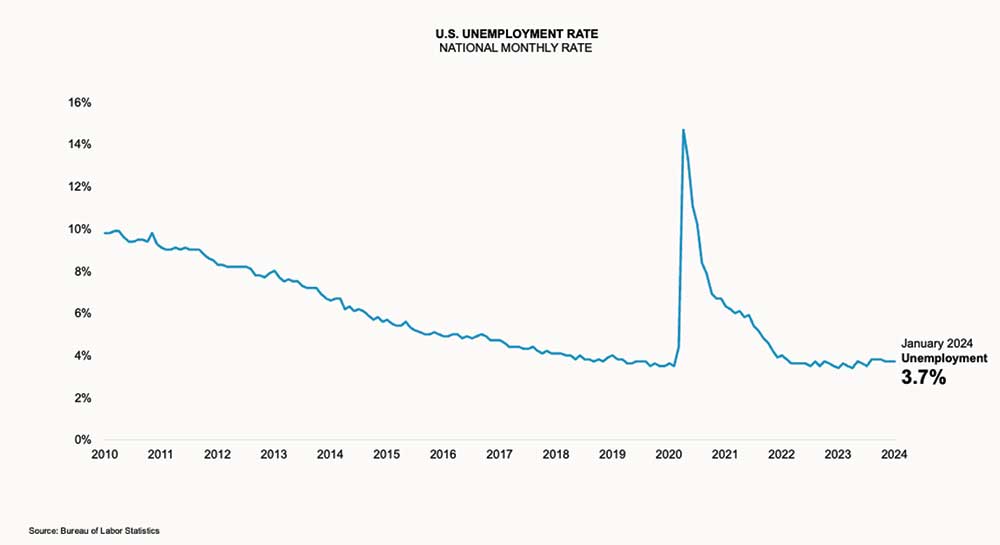

Consumers are benefiting from a strong job market. Recent job and unemployment reports indicate that the labor market is holding up well. For all of 2023, employers added 2.7 million jobs, a slowdown from 4.8 million in 2022 but a much better gain than in several years prior to the pandemic. The unemployment rate in December was unchanged from November at 3.7%. The rate at the start of the year was 3.4%. Fresh Produce and Floral Employment up year-over-year by 0.9%, gaining 10,589 jobs. The labor market and the consumer will shape the outlook for the economy as we go into 2024 and both are more consequential than ever.